The All-In-One CRM for Credit Unions & Banks

BusinessNext creates a unified view of every member and customer, enabling every department in your credit union or bank to serve better, cross-sell smarter, and grow relationships faster.

Trusted Partnership with

Packaged Solutions for Banks and Credit Unions

Deploy best-in-class and industry specific customer experiences to help your financial institution achieve its mission.

A CRM Built specifically for Credit Unions and Banks

4 of the 5 largest banking CRM implementations in the world are on CRMNEXT. Leverage global innovation packaged into a regionalized, market-ready solution to support your customer experiences.

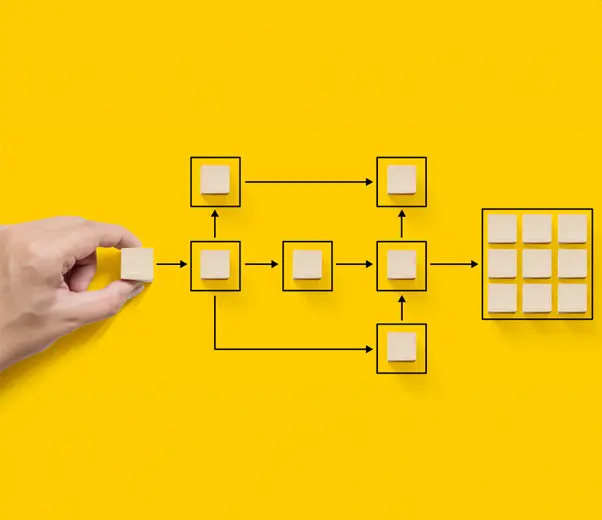

Leverage pre-built workflows, no-code design.

More than 80% of your standard operations will come already pre-built for your front lines and back office to operate in a compliant and SLA driven manner. Easily configure and personalize workflows relevant to your financial institution with our no-code design capabilities.

Achieve milestones quickly. Realize value with market ready packaged solutions.

Dismiss any fear of a lengthy implementation. Realize time to value quickly with an out-of-the box delivery model. Deploy prebuilt functionality to help your team hit their stride. Use decades of expertise to get your team trained and adopted to support of your mission.

CRMNEXT Recognized as a leader

what our

cutomers say

Ecosystem connector

UNLIMIT YOUR TRUE POTENTIAL.

#UpForTomorrow!

You’re curious and caring, someone excited about solving the hard problems with technology. Fear of the unknown doesn’t hold you back from acquiring new skills to become truly ready for the future and #UpForTomorrow.