How an experience layer works

Unifying data, creating action centers, and leveraging enriched data to drive an optimized customer and employee experience is what we deliver to you.

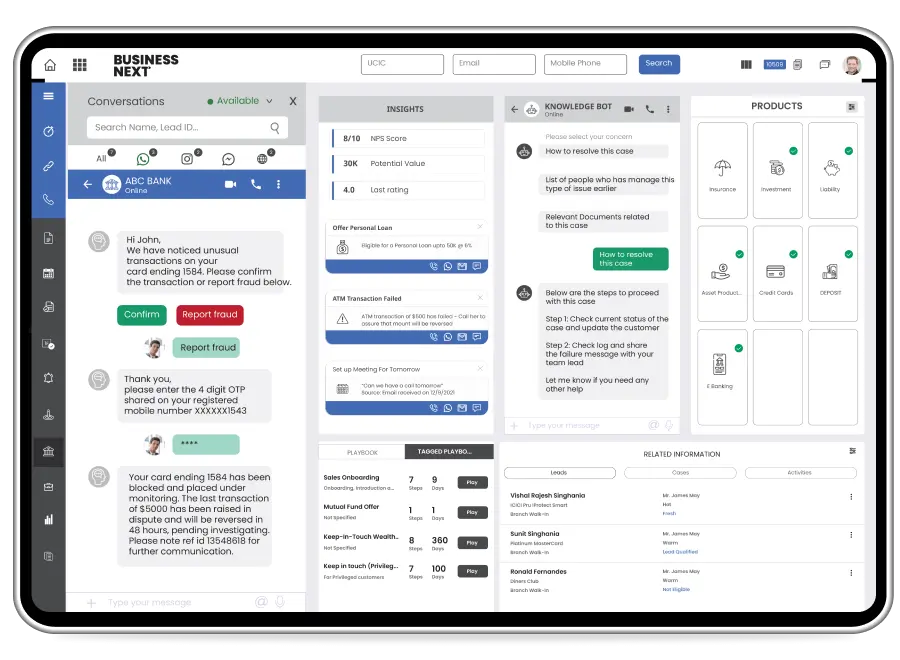

Retention services

Preventing churn and focusing on your customer’s needs is foundational to a growth strategy.

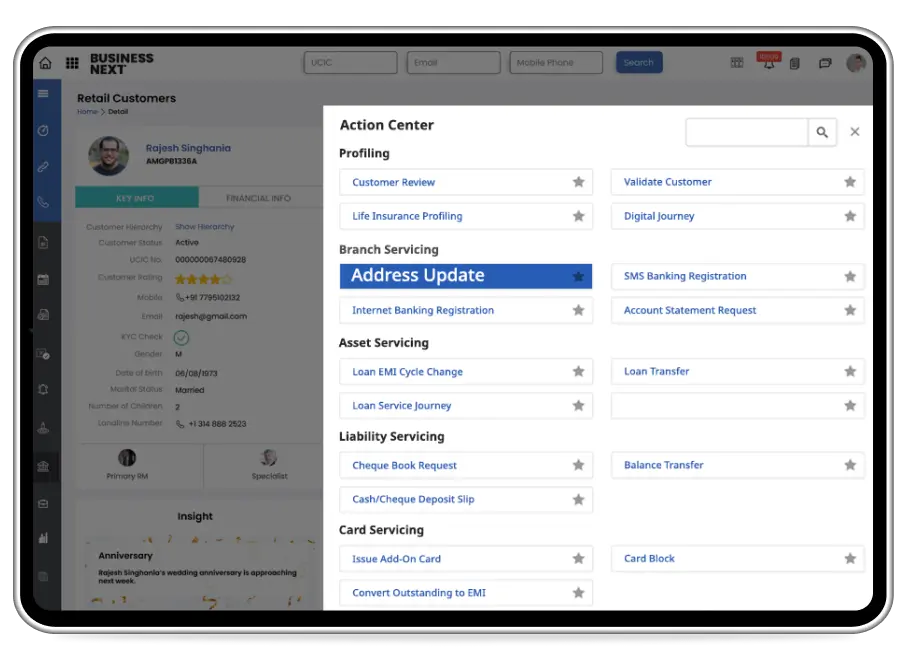

Great service is foundational

Bust through data silos and deliver a dynamic 360 view of your account holder to your team. In a simple, role based system, optimize user workflow powered by data, and insights with recommended next best actions. Manage every aspect of your services with Account Holders through your entire organization.

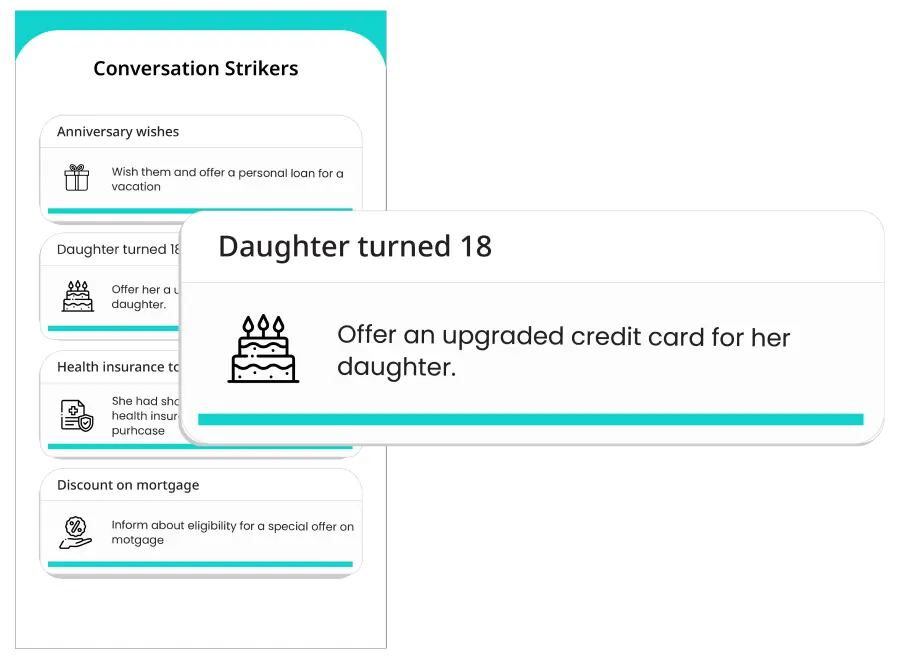

Deepen your Relationships

Be there for your customers in life’s financial moments.

Deepen your Relationships

Trust is earned, not given. With a foundational service layer, you now can leverage Insights and Actions to explore next best products and offers, and offer guidance and advice your Account Holders. Be the partner they want you to be.

ACQUIRE CUSTOMERS

Leverage our solution to understand your customer acquisition story in great detail.

A scalable acquisition strategy

Whether you are looking to acquire new account holders, or to drive more opportunity to existing consumers, leverage best in class sales management process, actions and deep insights to ensure your achieving goals.