-

Gartner CRM Excellence Awards for HDFC Bank Implementation

Gartner CRM Excellence Awards for HDFC Bank Implementation -

2023 Financial Service CRM Wave

2023 Financial Service CRM Wave -

Celent Model Bank Award for HDFC Bank Implementation

Celent Model Bank Award for HDFC Bank Implementation -

2022 Best CRM Implementation for Axis Bank

2022 Best CRM Implementation for Axis Bank -

Economic Times Award as the Best Organisation for Women

Economic Times Award as the Best Organisation for Women

Purpose built CRM for Banks and credit unions’

Anticipate financial moments with Account Holder’s to meet them where they are.

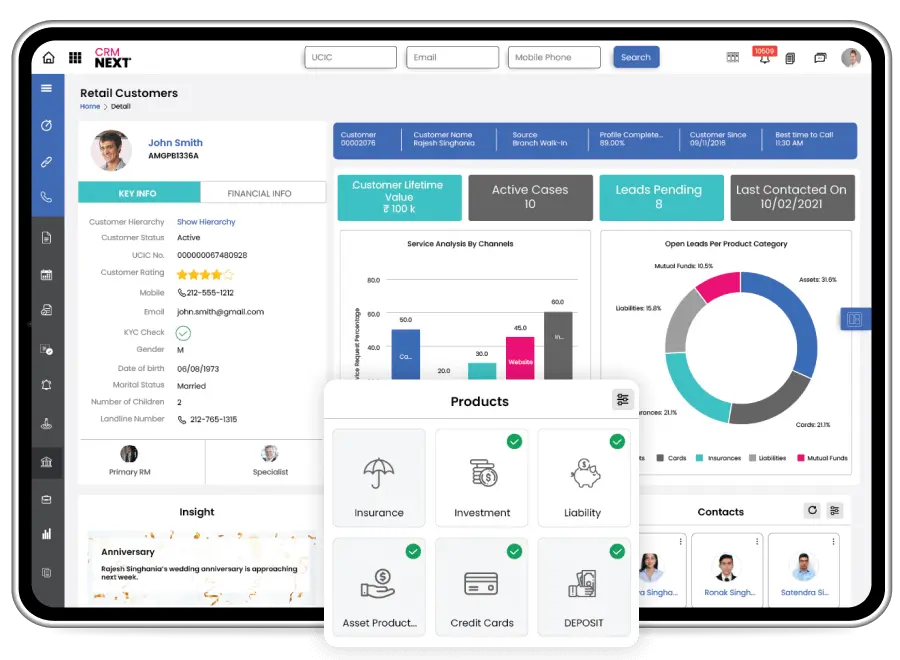

Customer 360

A configurable single pane of glass to view all information on your customer. In a role based system, we layout all fields of data from your core, and other banking technology to efficiently service customers.

Insight engine

AI driven data and analytics powers our Insight Engine to predict and suggest appropriate products and services for each account holder. Insights allow your team to meet the customer where they are.

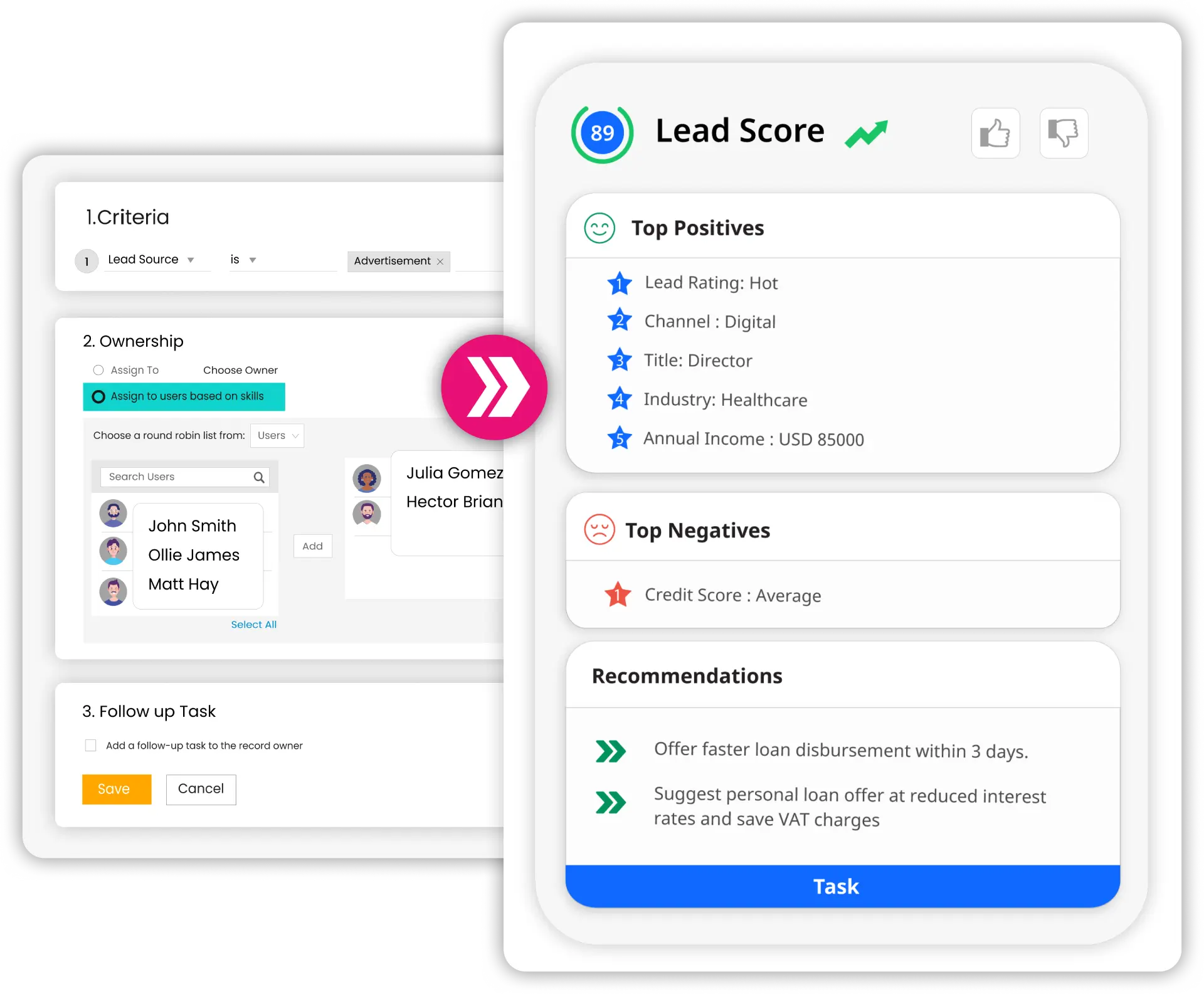

Leads

CRMNEXT brings action to your growth initiatives. Lead tracking streamlines the process of managing opportunities. Ensure nothing is missed and your team and Account Holders are connected for growth opportunities.

Lending

SImplify your loan processing workflow. Take advantage of real-time visibility and updates on each applicant’s status. For account holders, this translates into a faster, more transparent loan application process.

Marketing Automation

Segment audiences, personalize email and SMS communications, and track campaign performance. Activate relevant campaigns to your account holders and measure your campaign performance.

Reporting and Dashboards

Achieve operational excellence with a view into key metrics and data across every department. Give your team real-time access to pertinent information, leading to more informed strategies and key performance actions.

Case Management

Streamline your approach to handling customer issues, inquiries, and complaints. Enhance the efficiency and effectiveness of employee responses. Ensure all customer concerns are addressed promptly and effectively.

WorkFlows

Enjoy over 80% of your teams daily workflows already built, and ready to launch out-of-the box. Configure your own workflows with an easy to use no-code design studio.

Total Visibility

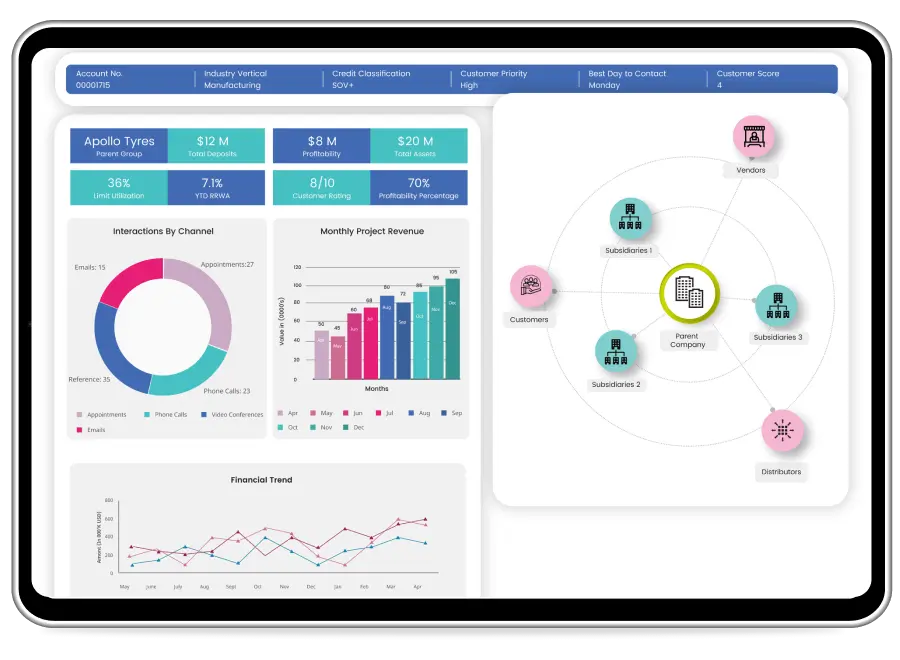

Deliver key insights with a dynamic and complete view of account holders to every customer facing role in your organization.

360 view

Aggregate, unify and organize disparate sources of customer data from your core and critical solutions technology stack to support your account holder’s every move.

Reporting and Dashboards

Utilize pre-built reports and dashboards or create your own custom reports that map to specific roles in your financial institution. Deliver on your mission by ensuring your KPI’s are met.

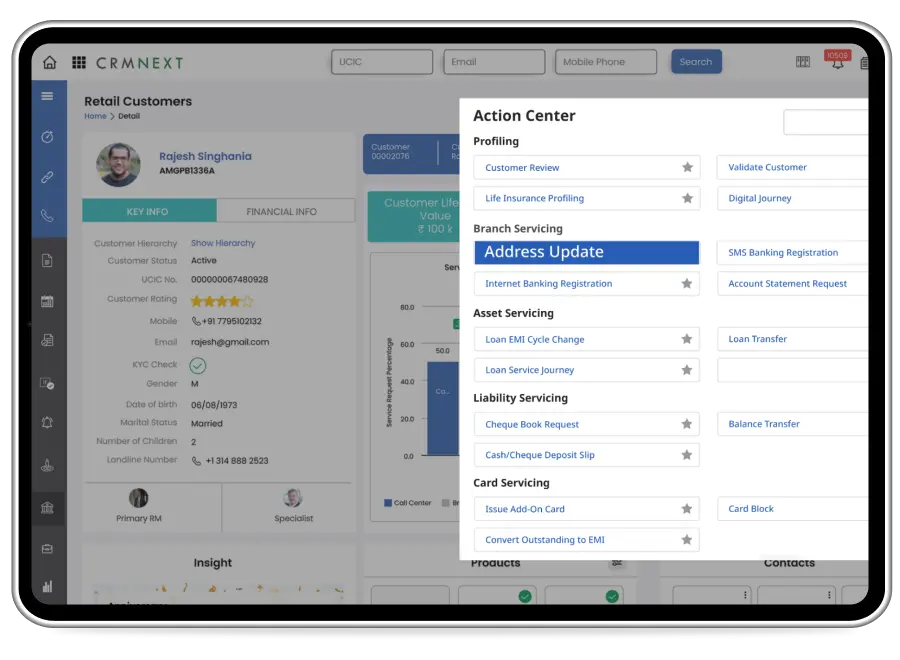

Personalization

Customers require guidance and personal attention as you advise them through financial moments. Make every interaction an experience that supports your mission and operational playbook.

marketing automation

Leverage audience segmentation and simple execution of marketing tactics to extend pre-approved promotions to account holders, at any stage of their journey.

Campaign Management

Track and measure what segments, campaigns, tactics, and offers have performed well. Syndicate and extend marketing strategy to front line teams as an integral piece of executing promotions and offers to your account holders.

Efficiency

Spend more time working with your customers by automating and removing tedious, manual back-end processes. Automate tasks and track SLA’s and ensure you’re achieving operational excellence.

Leads & referals

Quickly respond to opportunities with customers in search of financial products and services. Deliver a unified solution for all teammates to create, assist, and win new growth opportunities. Gain complete visibility into all stages, tasks, and next steps in your opportunity pipeline.

Case management

Drive best-in-class service levels in your organization. Ensure your response times and SLA’s are tracked and compliant. Leave no case unmanaged or unresolved. Grow NPS scores and generate customer referrals to

support growth.