Yes, it’s true. BusinessNext was recently recognized as a leading CRM for credit unions and banks – right at the very top of the list.

While we could spend all day celebrating this achievement, there’s a more important question to address: Why is BusinessNext the best CRM for credit unions and banks?

To answer this, I’m going to walk you through three core capabilities that set our CRM apart from the competition.

These aren’t just features – they’re solutions designed specifically for the unique challenges that financial institutions face every day.

Prefer to watch instead of read? We’ve created a video walkthrough covering these capabilities. Watch the video below, or continue reading – whichever format works best for you.

1. Acquire: Smart Member & Customer Acquisition

The foundation of growth starts with bringing in the right members and customers. Here’s how BusinessNext makes acquisition smarter and more effective.

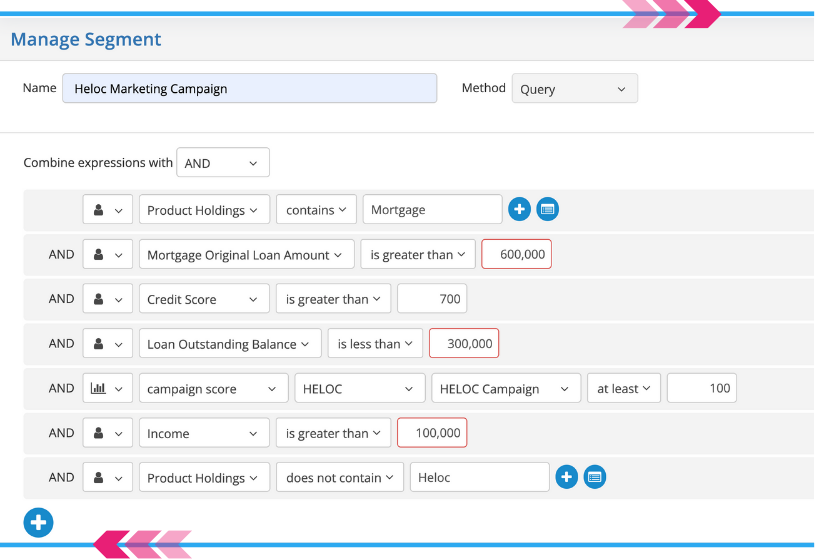

Intelligent Segmentation

Our CRM offers a unique ability to segment your marketing lists using both web-based behaviors and financial data.

For example, when you’re running a HELOC marketing campaign, our segmentation criteria is built specifically for credit unions and banks.

This means you’re not sending generic offers—you’re sending relevant, personalized offers that actually resonate with your audience.

Marketing Automation Made Simple

Once you’ve segmented your list, our drag-and-drop workflow builder lets you create automated marketing campaigns without needing a technical degree.

Design sophisticated nurture sequences, set up triggers based on member behavior, and let the system do the heavy lifting.

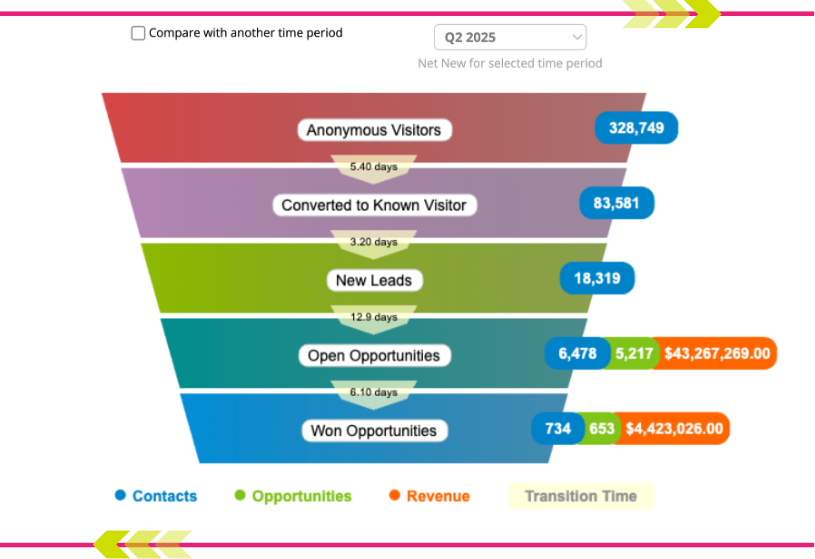

Revenue Attribution That Actually Works

Ever had someone ask, “Can you prove marketing is generating revenue?”

With BusinessNext, the answer is a confident yes.

Our revenue funnel report connects the dots between your marketing activities and actual revenue, giving you clear visibility into what’s working and what’s not.

2. Retain: Keeping Members & Customers Engaged

Acquiring new members and customers is expensive.

Keeping them happy?

That’s where the real value lies.

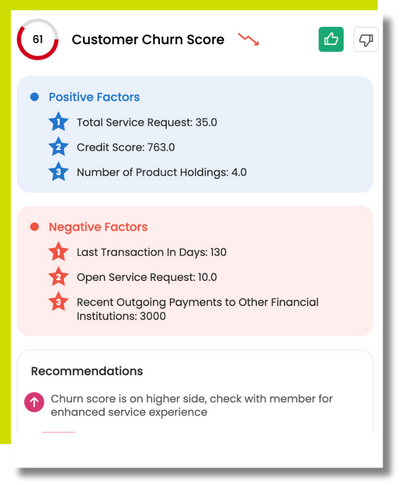

Churn Score: Your Early Warning System

We invest significant time and effort to acquire new relationships—the last thing you want is to lose them.

Our Churn Score provides a real-time view of early warning signs of churn, allowing your team to proactively address issues before members or customers walk out the door.

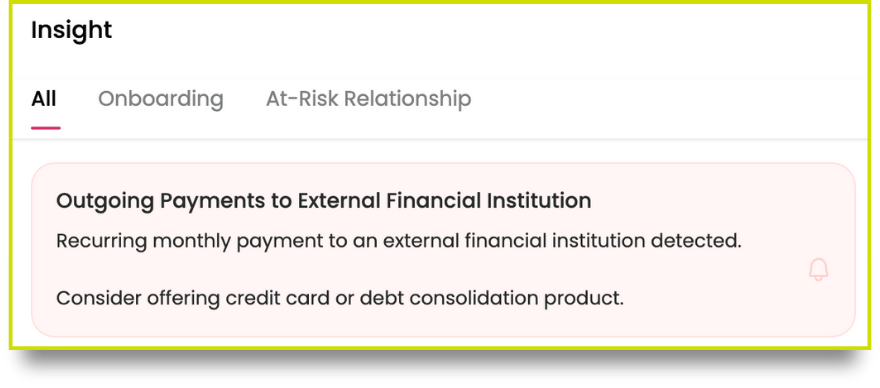

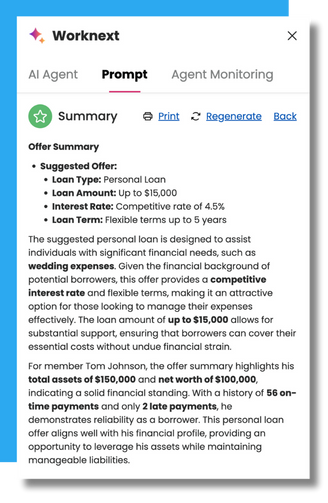

AI-Powered Conversation Intelligence

What’s top of mind for your members and customers right now?

Our generative AI surfaces the most up-to-date and relevant data to inform the discussions your frontline staff have with members.

When conversations, offers, and advice are relevant, retention follows naturally.

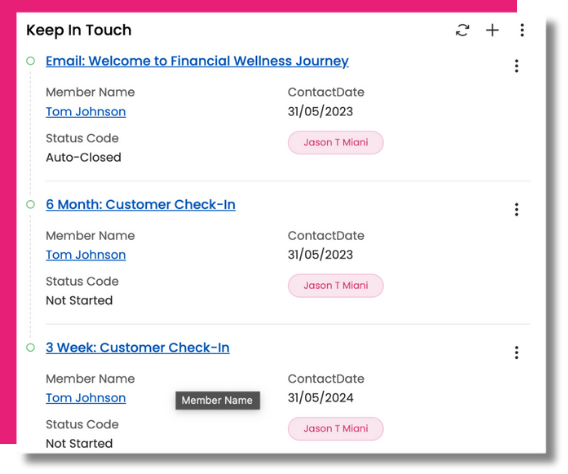

Automated Onboarding That Prevents Account Abandonment

Digital onboarding abandonment rates exceed 50% for deposit accounts and 75% for loans.

That’s a staggering statistic.

With our Keep In Touch feature, you can deploy guided, automated onboarding journeys that maintain consistent communication with new members and customers during those critical first months.

3. Deepen: Cross-Selling & Increasing Share of Wallet

You’ve acquired them, you’ve retained them—now it’s time to grow those relationships.

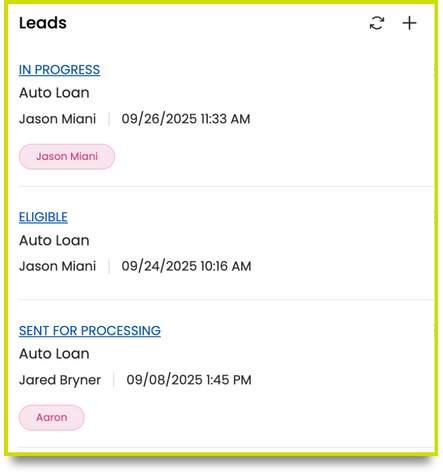

Never Lose Another Lead

How many times have you heard, “We lose leads on sticky notes or in emails”?

With our lead tracker, you can see every lead associated with a member or customer, the status of the lead, and you can automatically route it to the correct department for servicing.

No more lost opportunities.

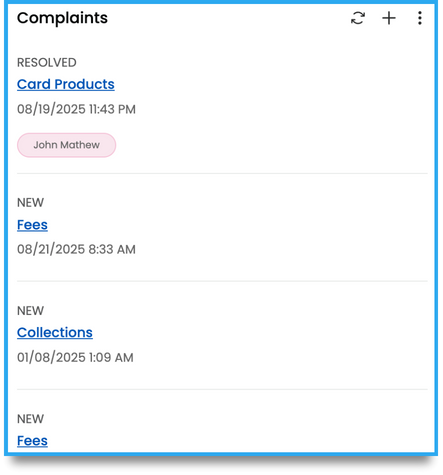

Cases & Complaints Management

Speed matters when it comes to resolving issues.

Our Cases & Complaints card serves as your centralized hub for member and customer servicing, helping you track resolution times and ensure nothing falls through the cracks.

Next Best Action Recommendations

If we had a dollar for every time we heard the phrase “right offer at the right time,” we’d be retired on a beach somewhere.

But that phrase exists for a reason—timing matters.

BusinessNext surfaces recommended next best actions directly in the Insight card, so your team can deliver personalized offers when they’ll have the most impact.

The Bottom Line

As one of the leading CRMs for credit unions and banks, BusinessNext is more than just a CRM—it’s a comprehensive platform that helps financial institutions acquire new members and customers, retain them through personalized engagement, and deepen relationships by increasing share of wallet.

What sets us apart is that our solution touches every department inside your financial institution. From marketing and sales to member services and lending, BusinessNext creates a unified experience that breaks down silos and ensures every team has the insights they need to deliver exceptional service.

But here’s the thing: what you’ve just seen is only about 5% of what our CRM can do.

Want to See More?

Every Tuesday at 12 PM Eastern, we host a live demo and Q&A session where you can see BusinessNext in action and get your questions answered directly.

If you’re ready to discover how our CRM can transform your member and customer relationships, sign up for Demo Tuesday.

We’d love to show you what makes BusinessNext the leading choice for forward-thinking credit unions and banks.

Leave a Reply

Your email is safe with us.