CRM isn’t just for sales and marketing anymore.

With Businessnext’s role-based dashboards, every department—whether it’s frontline service, lending, operations, or compliance—gets real-time insights tailored to what matters most for their role.

In this post, you’ll learn how banks and credit unions are using these dashboards to drive alignment, accountability, and action—turning data into decisions across the entire institution.

Why Most CRMs Only Serve One Team

Most CRMs were designed for sales—and it’s obvious.

They work well for pipelines and forecasting, but when service reps, loan officers, or compliance teams log in, they’re met with dashboards that don’t reflect their world. The result? Low adoption, scattered data, and an institution running without a full picture.

What’s missing?

BusinessNext isn’t just another CRM—it’s purpose-built for every department in your financial institution.

What Role-Based Dashboards Actually Do

Forget one-size-fits-all reporting.

With BusinessNext, every team gets a real-time dashboard built specifically for their role—so they can focus on the metrics, workflows, and insights that matter most.

You can easily build and customize dashboards for:

-

- Service and support teams to track case volume, resolution times, and satisfaction

- Lending and underwriting teams to monitor loan pipelines, cycle times, and risk flags

- Card operations to manage disputes, blocks, and fulfillment workflows

- Marketing teams to see campaign performance and lead conversion

- Compliance and risk teams to stay audit-ready with real-time reporting

- Executive leadership to view cross-functional performance and strategic KPIs

- And yes—sales and business development get their pipeline and opportunity views too

One CRM. Customized visibility for every corner of your financial institution.

How to Use BusinessNext Dashboards by Role

Step 1: Select or Create a Role-Based View

When a team member logs into BusinessNext, they’re greeted with a customized homepage tailored to their role—whether they’re in lending, service, compliance, or leadership.

Admins can start with out-of-the-box templates designed for common financial institution roles, or build fully custom dashboards using drag-and-drop widgets, filters, and data fields.

Each dashboard shows exactly what matters most to that user—no noise, no guesswork.

Step 2: Track Real-Time Metrics That Matter

Every team sees live data tailored to their responsibilities—keeping everyone aligned and accountable without digging through spreadsheets.

Examples by department:

-

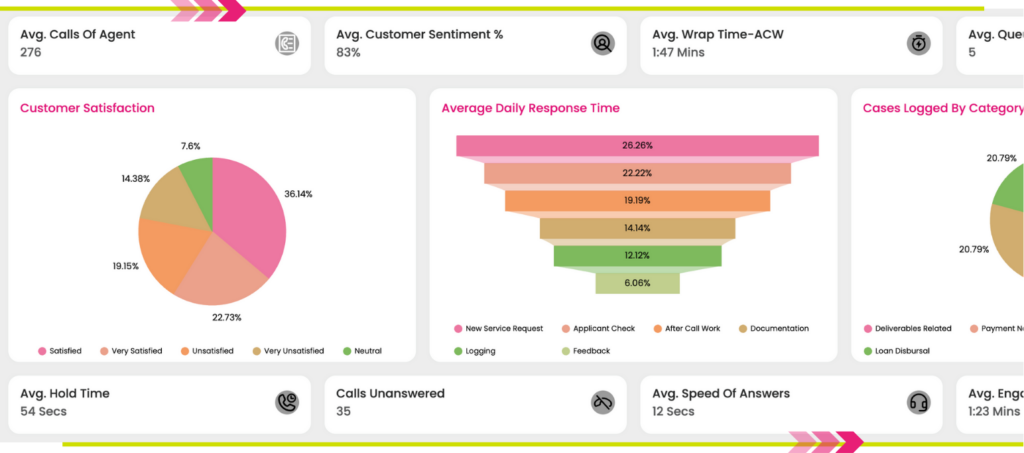

- Service Teams: Open cases by status, average resolution time, member/customer satisfaction

- Lending Teams: Application volume, approval rates, cycle times, risk alerts

- Marketing Teams: Campaign engagement, lead conversion rates, top-performing channels

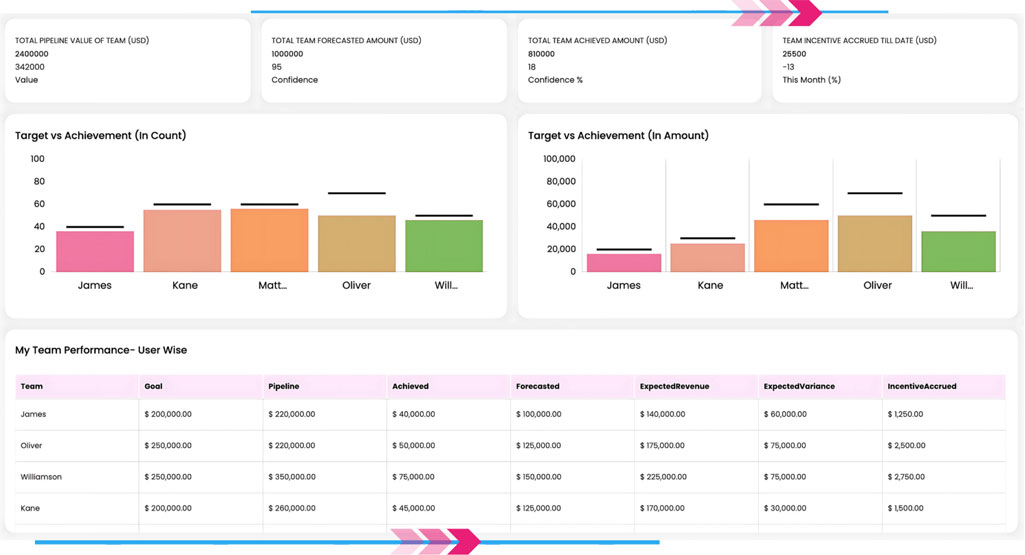

- Executive Leadership: Organization-wide KPIs, trend analysis, forecast vs. actual comparisons

All dashboards update in real time—powered directly by your CRM data, not static reports or manual exports.

Step 3: Take Action from the Dashboard

With BusinessNext, dashboards aren’t just passive reports—they’re interactive command centers.

Team members can click into any widget to drill down into the data or launch follow-up actions in real time—like:

-

- Routing a support case to the right department

- Flagging a lead for sales outreach

- Triggering an internal workflow or task

- Reviewing trends before making strategic adjustments

Dashboards in BusinessNext don’t just show what’s happening – they help you respond, improve, and move faster.

Real World Example: How Magnifi Financial Drives 93% Daily CRM Usage

Magnifi Financial Credit Union transformed their operations by implementing role-based dashboards that give every team member—from tellers to district VPs—exactly what they need to succeed. The result? 93% of employees now log in twice daily, with 88% using the system for 6+ hours daily.

Their secret wasn’t just having good dashboards—it was making sure each role had accountability and visibility into metrics that mattered to them. Branch managers can track team performance, tellers get real-time member insights for better service, and executives see organization-wide KPIs that drive strategic decisions. This member-centric approach helped them achieve a 60% lead close rate and 19% increase in referrals year-over-year.

As Magnifi’s leadership noted: “You’ve got to ensure that your CRM is used beyond your contact center”—and their role-specific dashboards prove that when teams see value in their daily workflows, adoption follows naturally.

Contact Center Dashboard View

Dashboards shouldn’t be limited to sales—and with BusinessNext, they’re not.

Whether you’re running service, lending, marketing, compliance, or executive strategy, role-based dashboards in BusinessNext’s CRM give every team the real-time visibility they need to take action.

No more one-size-fits-all views. Just relevant, real-time insights that help your entire financial institution move faster, stay aligned, and serve members and customers better.

See Role-Based Dashboards in Action

Want every team in your institution to act on the right data—without digging for it?

Join a Demo Tuesday session and explore how BusinessNext’s role-based dashboards give banks and credit unions real-time visibility tailored to every department.

What you’ll see:

- Out-of-the-box dashboards for service, lending, compliance, and more

- How teams can act directly from the dashboard—no toggling required

- Real-time insights that drive alignment, speed, and smarter decisions

👉 Reserve your spot or request a 1:1 demo today—and give your entire organization the visibility it deserves.

Leave a Reply

Your email is safe with us.